Are you experiencing a lot of overdraft fees or fees in general from your bank? Now, they can really be upsetting. Here are some tips for you to prevent them from happening. Once you start incorporating these tips then building your budget is the next step.

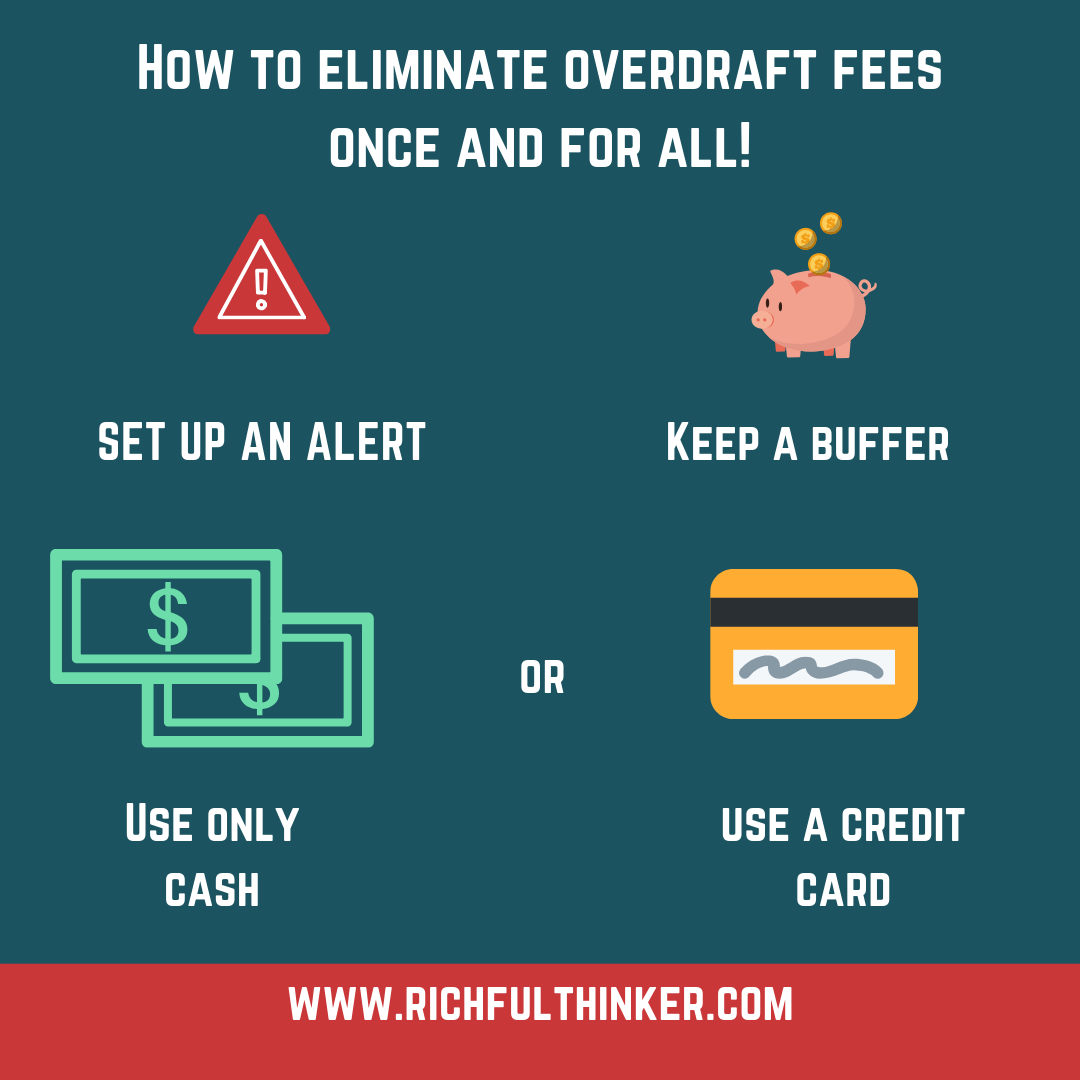

1. Set up an alert. If you speak to your banker they can set up an alert where you can receive a daily text of your bank balance or when it gets to a certain level.

2. Keep a buffer in your account. Essentially this is keeping a little extra in your account. Maybe it is a few dollars, personally I had to build this up slowly. Saving just $5.00 a week or a month will help you build up that little buffer.

3. Using cash. For those of you who follow Dave Ramsey then you know that he is all about cash being king. That only using cash will prevent any debt accrual and it also builds a relationship with your cash so that you do not want it to leave your hands. This is a bit psychological and it works for some people.

4. Using your credit cards. Carrying cash does not work for everyone. Especially for those that like to earn points from buying the things they normally would. As long as one can keep themselves in check then this is recommended. In addition, the benefit of using a credit card is that if there is a hold or there is fraud then your own money is not tied up. However, just like using cash is not for everyone, using a credit card is not for everyone.